Get the free nys certified payroll form

Show details

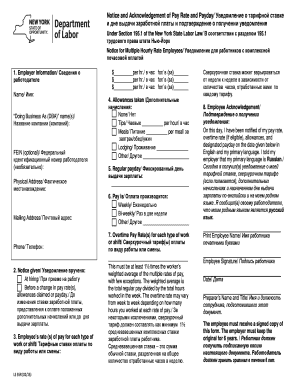

Department of Labor Bureau of Public Work WEEKLY PAYROLL For Contractor's Optional Use. The use of this form meets payroll notification requirements; as stated on the Payroll Records Notification.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ny certified payroll form

Edit your certified payroll forms ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your prevailing wage form ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nyc certified payroll form online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nys certified payroll form instructions. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certified payroll forms

How to fill out the NYS certified payroll form:

01

Obtain the NYS certified payroll form. This form can be found on the official website of the New York State Department of Labor.

02

Start by providing the necessary project information. This includes the project name, location, contract number, and prime contractor information.

03

Fill in the employee information section. Here, you will need to list the names, addresses, social security numbers, job classifications, and rates of pay for each employee working on the project.

04

Calculate the hours worked by each employee. This includes regular hours, overtime hours, and any applicable holiday or weekend hours.

05

Determine the wages earned by each employee. Multiply the hours worked by their respective rates of pay. Additionally, calculate any overtime or holiday pay as required.

06

Enter the deductions from wages section. Include any authorized deductions such as taxes, insurance premiums, or union dues.

07

Calculate the net wages earned by subtracting the deductions from the total wages earned for each employee.

08

Complete the employer's certification section. This includes the signature of an authorized representative certifying the accuracy of the information provided.

Who needs the NYS certified payroll form:

01

Contractors working on public works projects in the state of New York may be required to submit certified payroll forms.

02

Subcontractors working on these public works projects may also be required to submit certified payroll forms.

03

The New York State Department of Labor and other relevant agencies may request the NYS certified payroll form for auditing or compliance purposes.

Video instructions and help with filling out and completing nys certified payroll form

Instructions and Help about nys certified payroll

Fill

nys dol certified payroll form

: Try Risk Free

People Also Ask about nys certified payroll instructions

What is the Article 8 of the New York State Labor Law?

No laborer, worker or mechanic in the employ of a contractor or subcontractor engaged in the performance of any public work project shall be permitted to work more than eight hours in any day or more than five days in any week, except in cases of extraordinary emergency.

What is the local prevailing wage?

A prevailing wage is the basic hourly rate of wages and benefits paid to a number of similarly employed workers in a given geography.

How do I find my local prevailing wage?

How Are Prevailing Wages Determined? Employers can obtain this wage rate by submitting a request to the National Prevailing Wage Center (NPWC), or by accessing other legitimate sources of information such as the Online Wage Library, available for use in some programs.

What is prevailing wage in NY?

Prevailing wage is the pay rate set by law for work on public work projects. This applies to all laborers, workers or mechanics employed under a public work contract. The Bureau of Public Work administers Articles 8 and 9 of the New York State Labor Laws: Article 8 covers public construction.

What is a certified pay stub?

What is a certified payroll report? A CPR is an official compliance document that is required on local-, state-, and/or federal-funded projects. It details the worker's information, type of work performed, wages, benefits, and hours worked.

What is prevailing wage Washington State?

Prevailing Wage is the hourly wage paid to the majority of construction workers in the largest city in each county in Washington State, as determined for each trade by the Department of Labor & Industries (L&I). The General Contractor must display a list of these wages at the jobsite.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send certified payroll ny for eSignature?

When your new york state certified payroll form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find nys certified payroll forms?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the nyc comptroller certified payroll form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out nyc comptroller certified payroll report on an Android device?

Use the pdfFiller app for Android to finish your city of new york office of the comptroller certified payroll form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is nys certified payroll form?

The NYS certified payroll form is a document required in New York State for contractors and subcontractors to report the wages paid to workers on public works projects. It ensures compliance with state labor laws.

Who is required to file nys certified payroll form?

Every contractor and subcontractor who is engaged in public works projects in New York State is required to file the NYS certified payroll form.

How to fill out nys certified payroll form?

To fill out the NYS certified payroll form, you need to include information such as the contractor's details, employee names, classifications, hours worked, and wages paid. Ensure that all entries are accurate and complete, and then submit the form to the appropriate agency.

What is the purpose of nys certified payroll form?

The purpose of the NYS certified payroll form is to ensure that workers on public projects are being paid the correct wages in accordance with state labor laws, and to provide transparency and accountability in the payment process.

What information must be reported on nys certified payroll form?

The NYS certified payroll form must report details including the contractor's name and address, project name, employee names, job classifications, total hours worked, rate of pay, and deductions. Additionally, it must include certification statements confirming the accuracy of the reported information.

Fill out your nys certified payroll form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Llgov is not the form you're looking for?Search for another form here.

Keywords relevant to new york state blank certified payroll form

Related to ny state department of labor pw 12 new form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.